A rare 1999 platinum Rolex Daytona is set to go under the hammer at Sotheby’s Geneva auction this Sunday, with experts predicting it could fetch up to $1.7 million.

This unique timepiece, made from platinum, is one of only four known to exist. It was privately commissioned, making it highly unusual for a Rolex, which typically does not offer custom-made pieces. It is the last of the four to be sold, with the others having already reached impressive prices above $3 million.

Unlike other Rolex models, which are typically part of a standard collection, this Daytona was created for a specific client, making it an even rarer find. Pedro Reiser, senior watch specialist at Sotheby’s, noted that commissions like this are almost unheard of for Rolex. “Other brands may be more flexible in creating commissioned pieces, but Rolex rarely does this,” he said.

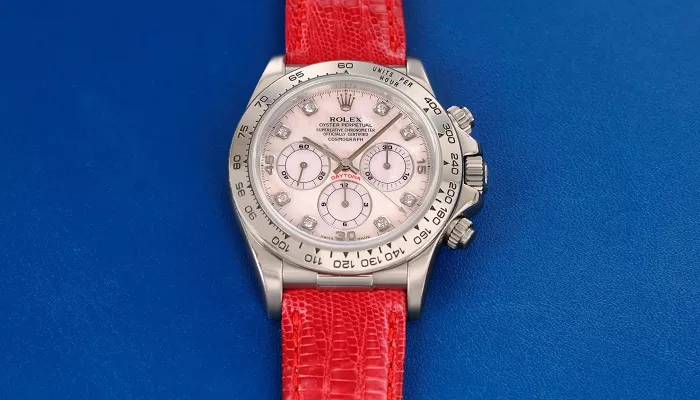

The watch features a mother-of-pearl dial, set with 10 diamonds. The other three watches made for the same family each have different dials, including lapis lazuli and turquoise, but none are diamond-set like this one.

This platinum Daytona is particularly significant as it was created before Rolex introduced platinum models in 2013. At the time, the Daytona was only available in stainless steel, yellow gold, and white gold, making this a one-of-a-kind piece in the brand’s history.

The watch has also attracted attention due to its connection to Patrick Heiniger, Rolex’s CEO from 1992 to 2008. Although there are rumors that Heiniger may have personally commissioned or worn a similar platinum Daytona, Reiser cautioned that there is no confirmed link to this specific watch. “It’s more of a myth,” Reiser said, though he acknowledged Heiniger’s fondness for platinum watches.

As the market for rare watches continues to grow, particularly among young collectors, prices for these high-end timepieces have surged. According to the latest Knight Frank index, watches have seen a 125% increase in value over the past decade, making them one of the top-performing luxury investments. Despite a slight dip in prices last year, watches remain a reliable long-term investment, with a five-year growth rate of 52.7%.

Reiser noted that the market for luxury watches is expanding globally, with an increasing number of international buyers and younger collectors entering the scene.

Related Topics: